Micro-ATM balance enquiry lets users check their bank account balance through a small, portable machine at a nearby store. It’s a simple and fast service for people living in remote areas where regular ATMs or banks aren’t easily available.

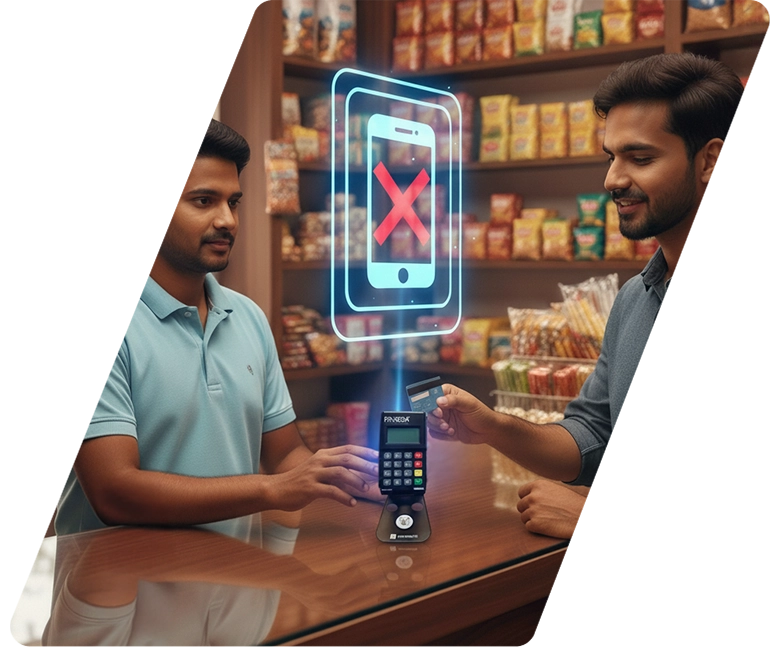

The customer visits a Finkeda-associated outlet and provides their debit card. The saathi inserts the card in the microATM and the customer will enter their PIN. Once these steps are completed, the balance is displayed on the device instantly. It is a quick, secure way to know account details without visiting a bank branch.

The microATM balance enquiry service is available to anyone with a debit card issued by their bank. It is perfect for people who live in rural, semi-urban, or low-connectivity areas, especially those with no immediate access to their banks or ATMs but still need fast account balance updates.

Yes, balance enquiry services through Finkeda Micro ATM are available 24/7. Even if you want to check your balance in the late evening or on a holiday, our merchant store will be open for you throughout the day. This service offers real convenience for daily financial needs.

A very small service fee may apply, depending on the bank. The saathi will clearly inform you about the charges before the transaction. You will also always receive a receipt or SMS confirmation for full transparency and peace of mind.

You just need to get registered with Finkeda. Once onboarded, we provide you with the Micro ATM device and guide you through the process. You will be able to help customers check balances alongside earning commissions on each successful enquiry.

You need a smartphone, an internet connection and the Finkeda-provided Micro ATM device. You do not need to have a complex setup or a large investment. The device is easy to carry and user-friendly to use in any retail space with no hassle.

As an saathi, you earn commissions for every balance enquiry. With instant settlements, hybrid mATM-mPOS devices and excellent customer support, you grow your income while helping your community access essential banking services easily and affordably.