Established in Rajasthan, marking the beginning of our journey.

2019-2020

Marked the beginning of our journey with just one goal of taking digital banking solutions to every village in India. Rajasthan is where that dream was born and is now growing.

2020-2021

Started offering digital payment solutions in rural areas as a Business Correspondent (BC) partner.

2021-2022

Rolled out AePS, Micro ATM and more services across small villages and towns in India to take banking solutions to every doorstep.

2022-2023

We expanded our offerings to offer a diverse range of travel services.

2023-2024

We introduced digital insurance as part of our ongoing effort to make necessary financial services more accessible to everybody.

2024-2025

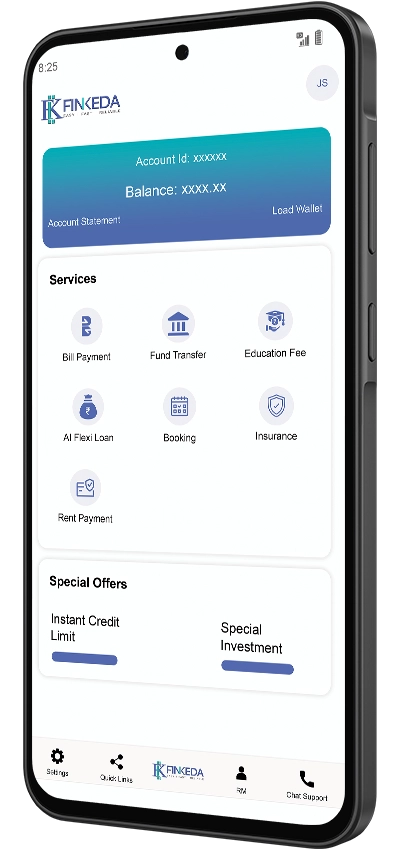

We are broadening our financial offerings to provide underprivileged communities with access to credit and wealth-building opportunities.

2025-2026

We expanded from the B2B segment into B2C with the launch of our Finkeda Prime App, introducing new products - AI Flexi Loans, along with Insurance, Travel, Lending, and Investment services.

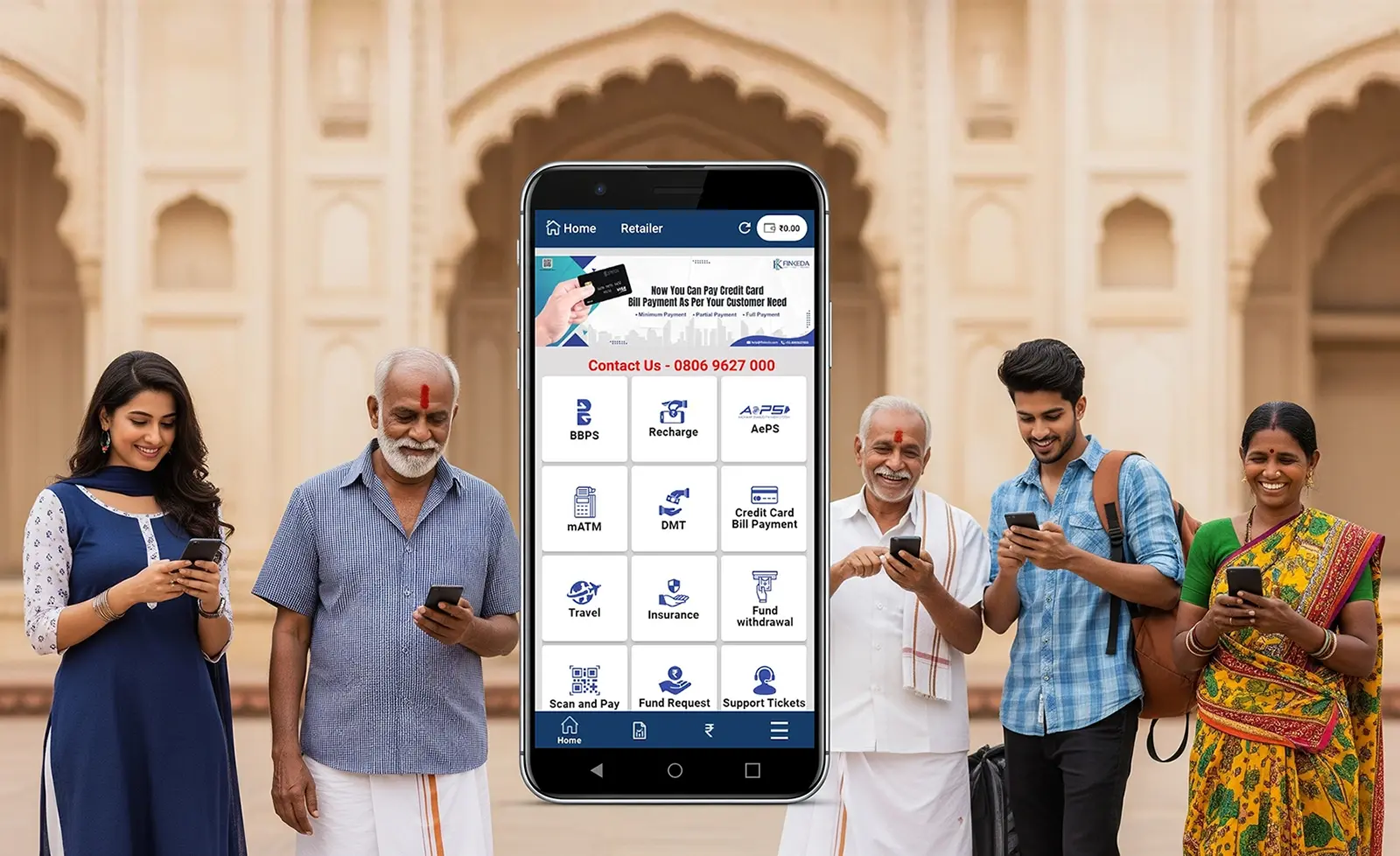

With micro ATMs & AePS, we’ve made advanced finance feel just like neighbourhood shopping.

Individuals from rural areas often need to travel to different villages for their banking and financial needs.

There are limited wealth-building products available in small towns and rural regions.

Local merchants not only deal with thin profit margins but also have limited income opportunities.

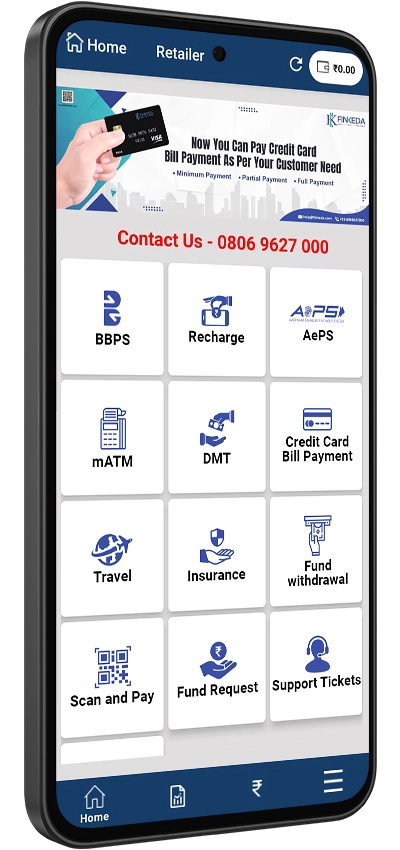

We equip shopkeepers with easy-to-use tech tools to offer banking, travel, insurance, and more.

All our real-time secure payments are backed by robust tech and transparent support.

Be it banking, bookings, or bills, we offer all services in one stop with Finkeda-powered stores.

Our app is simple, user-friendly, and offers access to all our services.

Depending on the service, commissions from Finkeda’s reliable and rural financial services are disbursed either immediately or daily. You can keep tabs on everything from your agent dashboard.

A failed AePS transaction often reverses itself within 72 hours if the amount has been debited from the customer’s account. During this time, you can avail our assistance at all times.

mATM offers all banking services, including cash withdrawals, mini statement printouts, and balance enquiries. Finkeda’s merchant partner streamlines your financial activities with convenience.

You must sign up as a merchant with Finkeda to offer rural financial services in your village. These digital banking services include AePS, utility bill payments, Micro ATM, insurance and more.

By converting stores into online banking hubs, merchants generate more revenue, increase foot traffic, and offer essential services, which include, but are not restricted to, bill pay, cash withdrawal, and recharges.

Finkeda offers the best financial services, which not only encourage accessibility but also convenience. You can pay your gas, water and electricity bills by using utility payment services.

Yes, Finkeda’s platform adheres to stringent security guidelines to provide secure, easy access to reliable financial services across India.

Indeed! You earn from every transaction, including bill payments and recharges, while benefitting your rural community with Finkeda’s banking services.

With AePS, you can provide micro statements, balance checks, and withdrawals. It helps us bring rural financial services closer to users without requiring them to visit a bank.

Total Merchants

Average Transaction Value

Transactions Per Month

Total Employees