A Micro-ATM is a small, portable device operated by a local retailer. Unlike big ATMs, it doesn’t need large machines or high setup costs. It allows basic banking services like cash withdrawals and balance checks in areas with limited access to banks, especially in rural and remote locations.

Visit your local Finkeda office with your debit card. Our Finkeda saathi will insert your card into the machine, assist you in entering your PIN and complete the withdrawal. You receive the money immediately and a receipt or message as proof of the success of your transaction.

You can withdraw a maximum of ₹10,000 per transaction with Finkeda’s Micro-ATM. This helps manage daily needs without visiting a distant bank. Multiple transactions may be allowed depending on the bank’s rules. Your saathi can guide you based on your card type and bank account limits.

Yes, a small service charge may apply for each transaction, depending on your bank’s policy. It is usually minimal and helps cover operational costs. The saathi will inform you of any charges before processing. You also get a receipt for full transparency.

All you need is a smartphone, internet connection, and a Micro-ATM device provided by Finkeda. It is simple to set up and does not require a major investment. The device is portable, user-friendly and comes with a one-year warranty and complete support from Finkeda.

Just register with Finkeda. Once approved, we’ll guide you through the setup and provide the mATM device. You’ll get training and support to start offering services like cash withdrawals and balance enquiries at your shop. It’s a great way to earn and help your community.

No banking license is needed. As a registered Finkeda saathi, you are authorized to offer Micro-ATM services legally. We handle the technical and compliance side. You just need to focus on helping customers with simple, secure transactions at your retail store.

Finkeda does offer comprehensive training to assist you in using the Micro-ATM device. For technical assistance or problems, our support staff is available at all times. We also offer a one-year warranty so that your services will function flawlessly and hassle-free.

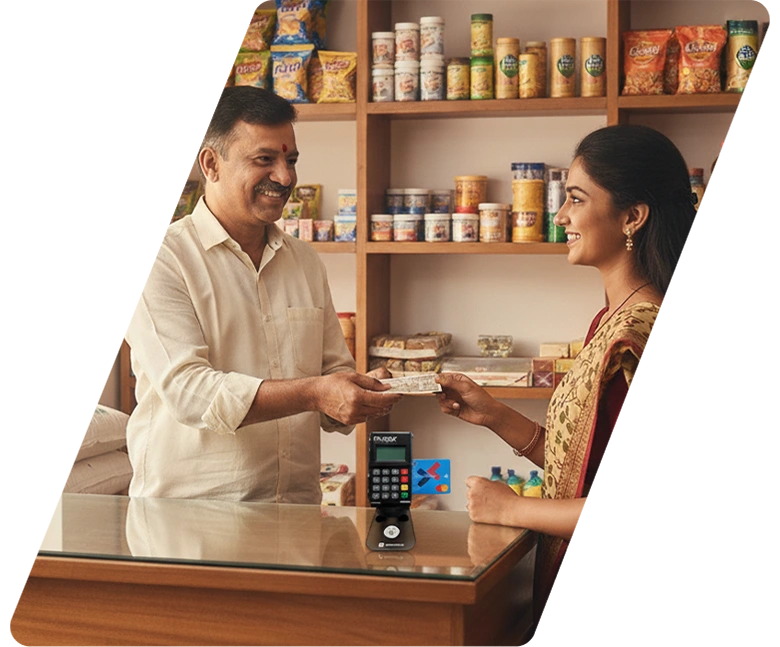

In today's fast-paced digital economy, in rural and semi-urban areas, basic banking services are still a challenge. This is where Finkeda merchants play a transformative role by providing Micro ATM Services at your nearby Finkeda merchant store. By becoming a trusted banking point in the community, merchants not only support financial inclusion but also unlock a steady source of income for their business.

Mini ATM, Mini ATM Machine, mATM device are a few names of Micro ATM Machine, it’s a compact electronic device that gives access to banking services like Cash Withdrawal & Balance Enquiry to the customers. They are modern ATMs and nothing like traditional ATMs, as this does not require heavy infrastructure or high investment, making it a perfect ATM for shop owners.

With Finkeda’s advanced Micro ATM solution, merchants can offer essential services such as:

Micro ATM service provided by the Finkeda merchant is not just about convenience; it's also about an opportunity to grow their business. Customers in today's fast-paced world prefer nearby and hassle-free banking options rather than travelling long distances or waiting in line at banks.

A reliable source of banking services is the Micro ATM service provided by nearby shopowners, which in turn forms a trustworthy eco-system. Whether it’s a kirana store, mobile shop, medical store, or CSC center, a Micro ATM device fits seamlessly into any retail setup.

Let's look into the benefits of Micro ATM and how it's designed to be simple, secure, merchant and customer friendly.

The most in-demand services are Cash Withdrawal & Balance Enquiry, especially in areas with limited bank branches. With Finkeda’s Micro ATM service, customers can withdraw cash instantly using their Debit Card. It acts as a mini cash withdrawal machine.

The customers can avail Balance Enquiry services without visiting the bank. They can keep track of their finances hassle-free. Therefore, the merchant shop becomes a one-stop shop for all daily financial needs.

Finkeda merchants bridge the gap between banks and underserved communities. By offering the Micro ATM services, less tech-savvy individuals, senior citizens, daily wage workers, and rural customers can access their money safely and easily. Dependency on distant bank branches is reduced.

Finkeda stands out as a trusted Micro ATM service provider because of its robust technology, reliable support, and merchant-first approach. From onboarding and training to transaction support, Finkeda ensures that merchants feel confident while delivering Mini ATM services.

With Finkeda, merchants are not just providing transactions; they are delivering trust, convenience, and empowerment to their community.