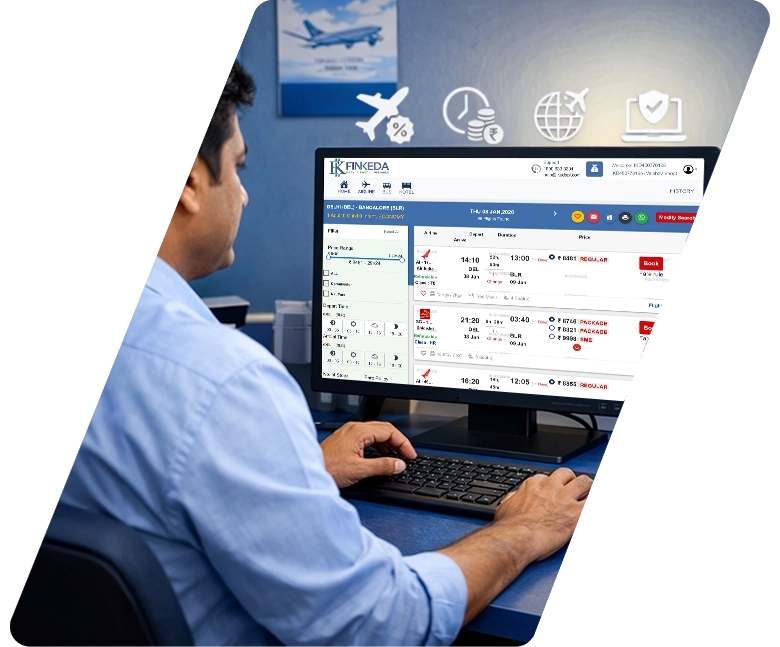

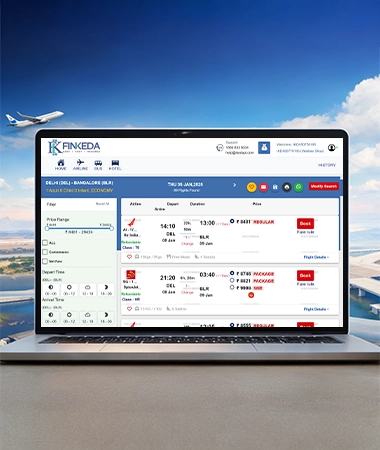

If you are a Finkeda Saathi, you can use our booking platform to search for both domestic and international flights. Just enter the client’s travel details, select a payment method, and finish the transaction. The platform shows prices in real time and instantly verifies the reservation with an e-ticket.

Yes. Most tickets can be changed or canceled as per the airline’s policy. The Finkeda Saathi will also help customers with the process directly by using the booking panel. However, refunds and change charges will depend on the airline’s rules and the time left before departure.

Yes. With Finkeda, you will get great flight deals and super-saving fares. These discounted prices will also help Finkeda Saathis offer competitive rates to customers. Cashback or special offers may be available during specific periods and are shown during the booking.

Finkeda supports multiple payment options. You can pay using net banking, UPI, debit or credit cards or use the wallet balance linked to your Saathi account. The process is simple, secure and supports quick confirmation of bookings.

Yes. Small agencies and travel agents can register as Finkeda Saathis and use the platform to book flights. The system is easy to use and is made to help them expand their travel agency by providing seamless service and higher commissions.

After successful payment, the e-ticket is generated instantly. This is sent to the registered email. You can also download it from the dashboard. The Finkeda Saathi can print or forward it to you within minutes.

Yes. Finkeda allows group and bulk bookings. For such requests, you can reach out to our Finkeda Saathi. They will connect with the support team to get special fares or assistance. It is perfect for tour operators, schools and corporate clients needing multiple tickets.

Flight status and PNR details can be checked directly through the Finkeda platform. You only need to enter the PNR or booking reference. You will receive real-time updates on flight schedule, gate info and delays to stay informed.

Yes, the majority of airlines permit extra baggage, meals, and seat preference. These can be chosen at the time of booking or afterwards. In accordance with the airline’s policy and pricing schedule, the Finkeda Saathi can assist in making these adjustments.

Yes. Finkeda provides 24/7 customer service for all flight reservations. Saathis can get in touch at any time if there are problems with tickets, refunds, or modifications. Our staff is available to provide prompt assistance and solutions.