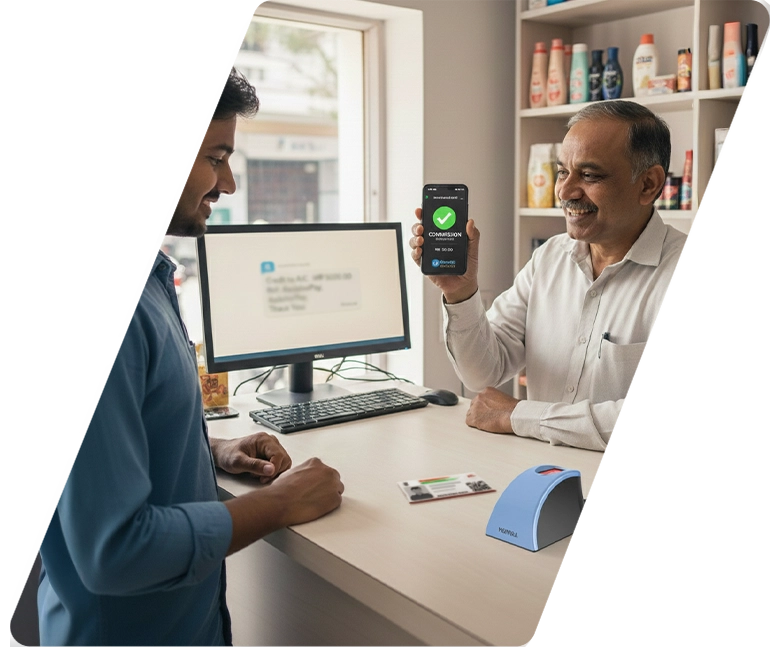

AePS (Aadhaar Enabled Payment System) cash deposit enables customers to deposit money in their bank account based on their Aadhaar number and fingerprint alone. Agents at Finkeda outlets make use of a biometric scanner connected to the Finkeda portal to identify the customer. The amount deposited is credited to the Aadhaar-linked bank account immediately.

Finkeda supports cash deposits through most major banks in India that are part of the AePS network, including State Bank of India, Punjab National Bank, Bank of Baroda, HDFC Bank and others integrated with NPCI’s AEPS system. As long as the customer’s Aadhaar is linked to a participating bank, deposits are enabled.

Here’s how a typical AEPS cash deposit works at a Finkeda merchant point:

Yes. Finkeda AePS services are designed to work with minimal internet bandwidth, making them ideal for rural or low-connectivity zones. A basic 2G network is usually sufficient. Transactions are processed through lightweight, encrypted requests to NPCI and UIDAI servers. It allows merchants to operate reliably even in remote areas.

Merchants need a UIDAI-approved biometric device. These devices connect via USB or OTG to desktops or Android phones and comply with RD (Registered Device) service requirements. The Finkeda platform is compatible with all major RD-enabled fingerprint scanners.

Yes. AePS is based on the safe biometric authentication system of UIDAI and is regulated by the NPCI. Each transaction involves real-time Aadhaar number and fingerprint authentication through the server of UIDAI for ensuring the security of the data. Finkeda employs encrypted communication and adheres to all regulatory requirements for ensuring secure customer transactions.

Retailers can register by submitting basic KYC documents such as Aadhaar, PAN and a passport-size photo via the Finkeda onboarding portal or app. After approval, they receive login credentials, training and a device integration guide. Once setup is complete, they can start offering AEPS cash deposit services to customers.