AePS is used mainly for banking services like cash withdrawal or balance check. Aadhaar Pay is for payments. Customers use their Aadhaar and fingerprint to pay directly from their bank account without a card or PIN. It’s perfect for quick, safe purchases at a local Finkeda merchant’s shop.

Anyone with a bank account linked to their Aadhaar number can use Aadhaar Pay. It’s ideal for people who may not have smartphones or debit cards. Just a fingerprint and Aadhaar number are enough to pay securely at any nearby Finkeda merchant store.

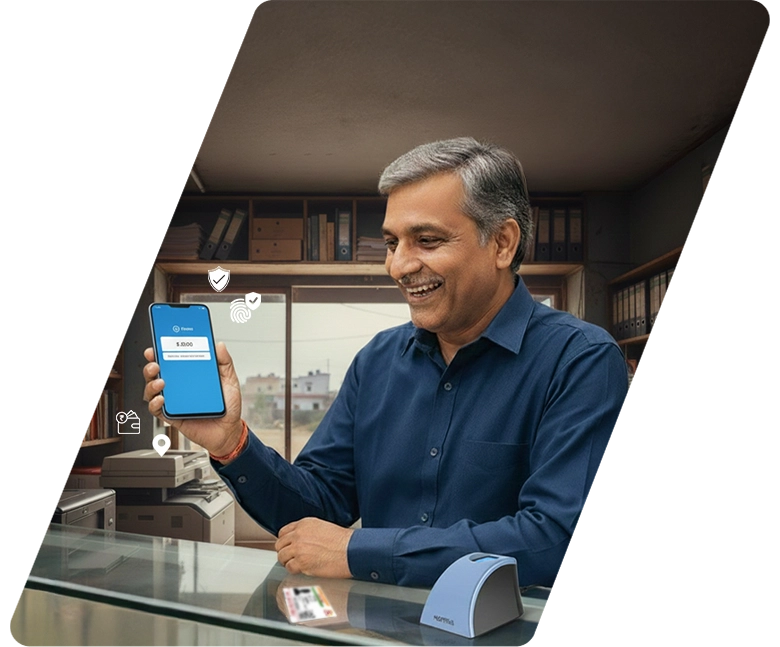

Visit a Finkeda store, give your Aadhaar number, and place your finger on the biometric scanner. The amount gets debited directly from your bank account. No card or phone needed. You get an instant receipt or message, and the merchant receives payment immediately.

To offer Aadhaar Pay, register with Finkeda as a merchant. We’ll provide you with a biometric device and complete training. Once set up, you can start accepting Aadhaar-based payments from customers and earn commissions on every transaction right from your store.

Yes, Finkeda follows strict security and regulatory standards. Aadhaar Pay uses biometric authentication and encrypted systems to ensure every transaction is safe. You’ll be using certified devices, and we provide ongoing support to keep your setup compliant and running smoothly.

You only need a smartphone, an internet connection, and a fingerprint scanner. Finkeda provides the Aadhaar Pay application and biometric device. It’s an affordable setup, easy to install, and works well in even small retail spaces in rural and remote areas.

Finkeda’s Aadhaar services are available across India, including rural, remote, and Tier 2 and 3 cities. Our network of merchants brings banking and payment services to people who don’t have access to digital tools, helping bridge the financial gap in underserved areas.

Aadhaar Pay helps people who don’t use cards, smartphones, or apps. With just an Aadhaar number and fingerprint, they can make payments easily. This makes digital transactions accessible for the elderly, low-income workers, and rural families, bringing them into the formal financial system.

Unlike UPI or card payments, Aadhaar Pay doesn’t need a smartphone, PIN, or internet access for customers. Payments are made using just Aadhaar and fingerprint. This reduces fraud, lowers transaction costs, and is more convenient for people in areas with low digital literacy.

Aadhaar Pay brings safe, cashless transactions to the last mile. It supports the vision of a digitally empowered India by giving everyone, even without phones or cards, the ability to pay and receive money. This helps build a more connected, inclusive economy from the ground up.